Mastering Emotions in Trading: Finding Focus Amid Chaos

Trading is as much about managing emotions as it is about understanding the markets. In a recent discussion, we explored how emotional awareness, cognitive focus, and deliberate action are critical for success.

Drawing parallels between trading and other high-stakes professions, such as surgery, we examined how recognizing and addressing emotional states can lead to more focused and proactive decision-making. Here’s a breakdown of my insights:

The Emotional Landscape of Trading

- • Emotional Awareness: Recognizing the specific emotion you are feeling, whether it’s confusion, frustration, or excitement, is the first step toward managing it. Naming the emotion — e.g., “I feel frustrated” — creates a separation between you and the feeling, allowing you to observe it without being overwhelmed.

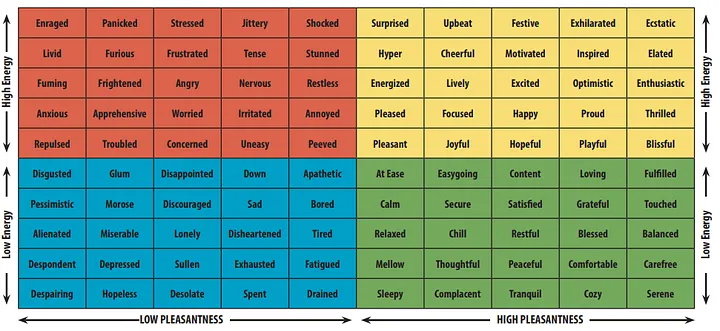

- • The Mood Meter Tool: Tools like a mood meter, which plots emotions along axes of energy (low to high) and positivity (negative to positive), can help traders identify their emotional states with precision. Adding a third “focus” dimension (the Z-axis) helps account for cognitive awareness, answering the question: “How focused am I in this emotional state?”

Using Emotional Insights as Information

- • Confusion as a Signal: When Tesla’s stock unexpectedly jumped due to a shift in market perception — from a car company to an energy leader — many institutional investors felt confused. This emotional state signaled the need for further analysis rather than reactive trading

- • Emotions as Wake-Up Calls: Just like a surgeon encountering unexpected bleeding during an operation must refocus on the immediate issue, traders must refocus when emotions like shock or frustration arise. The emotion itself is information, a reminder to pause and adapt

Proactive vs. Reactive Decision-Making

- • Recognize Emotional Triggers: Awareness of personal emotional patterns is key. For instance, if a market downturn triggers self-critical thoughts rooted in past experiences, acknowledging this connection can prevent spiraling

- • Use Centering Techniques: A few deep breaths or a moment of mindfulness can help regain focus without needing to step away entirely. This ability to “center” is crucial in maintaining composure during rapid market changes

- • Know When to Step Away: If emotions become overwhelming — like being “triggered” by past critical voices — it’s okay to take a short break. A quick walk or deep breathing can reset your mindset

Building Emotional Awareness: The First Step

While ultimate mastery involves staying centered across various emotional states, the initial goal for traders should be simple: develop emotional awareness. Recognize what you’re feeling and why, without judgment. This foundational skill creates a baseline for more advanced techniques, such as refocusing and emotional regulation.

Conclusion

Trading isn’t about avoiding emotions — it’s about understanding and leveraging them. By building emotional awareness and staying centered, traders can transform their feelings into a tool for sharper, more effective decisions. After all, success in trading comes not from being emotionless but from mastering the art of emotional focus.